Exercising business ownership through the stock market is hard enough. The pressure to be a stock speculator is overwhelming. And it just got a little harder. A Bloomberg Opinion column from October 20, entitled, “Those Vanishing Stock Dividends Should Stay That Way,” took up the case of a junk rated (BB), highly cyclical mining company that cancelled its miniscule dividend in March of this year. The piece trumpeted that the stock’s share price rallied sharply off the bottom of the market that month. The author wrote that “shareholders appeared to send the message that they would prefer [the company] put the $290 million or so it was paying out as a dividend each year to better use during these unprecedented times.” Embedded in the piece is a mini-chart entitled “No dividends, no problem.”

Let’s just be clear: serious dividend investors don’t own BB mining companies with a 2% yield. Those who owned it before the cut and those who owned it after the cut couldn’t care less about the dividend. Correlation is not causation. In this case, it is barely coincidence.

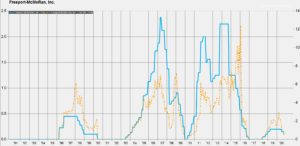

The argument also fails the basic M&M test underpinning the suggestion that the company cut the dividend to invest in the business: its payout was just $291 million vs. capex of $2.65 billion in 2019. These are not seriously competing categories. The company cut the dividend because business was really lousy, and it made sense for a company whose business is lousy to not make a profit distribution. You can’t distribute profits that you don’t earn. Indeed, picking this stock to pen an anti-dividend screed makes even less sense because the company in question has cut and reinstated its dividend numerous times over the the past 20 years. (Source: Factset) And now, according to the columnist, its latest dividend elimination was the correct capital allocation decision.

The author’s broader argument about using a historical turning point to invest in “innovative disruption” rather than pay dividends is certainly worthy of discussion, but you do need examples where the two spending directions are in opposition. That’s not the case for about 90% or so of the S&P 500 Index where a simple measure of free cashflow (net income + depreciation – capex) is well ahead of aggregate dividend payments, by a lot, and has been consistently since the early 1990s, with two brief exceptions for the recessions of 2001 and 2008-2009. It is simply incorrect to state that for the large cap S&P 500 Index companies dividends compete with business investment. And to point out the innovative tech stocks only weakens the argument. Those leading lights have massive free cashflows and don’t pay dividends (or pay minimal ones). There is no issue of competing priorities. Those companies could easily afford to pay dividends and still fund all of their initiatives. They are not successful because they don’t pay dividends; they are successful because they are innovative. It’s unfortunate that they don’t distribute a portion of those profits to company owners, but that’s a topic for another day. In the meantime, let’s not confuse cause and effect.

Ironically, the utility sector is the only part of the economy where the author’s distribution versus investment concern remains structurally valid (and the basic M&M proposition still holds). Your local electric and natural gas distribution utilities are consistently free cashflow negative due to substantial capital expenditure programs. That is how they grow. With smaller dividends, they would need to raise less external capital. Yet, I don’t think that’s what the author had in mind when being supportive of “innovative disruption.”

The ability to have and distribute a cash profit after all of a company’s investment needs have been met is the measure of a successful enterprise. When that enterprise is public, the distribution is a dividend. It is a sign of success, not failure. Now is indeed a time for heightened investment for many companies in the US and global economy. The success of those investments will lead to higher, not lower, profit distributions in the future.